Want to be in the loop?

subscribe to

our notification

Business News

REVIEW OF VIETNAM’S ECONOMY 2022: GLOBAL & LOCAL HEADWINDS HAVE JUST BEGUN

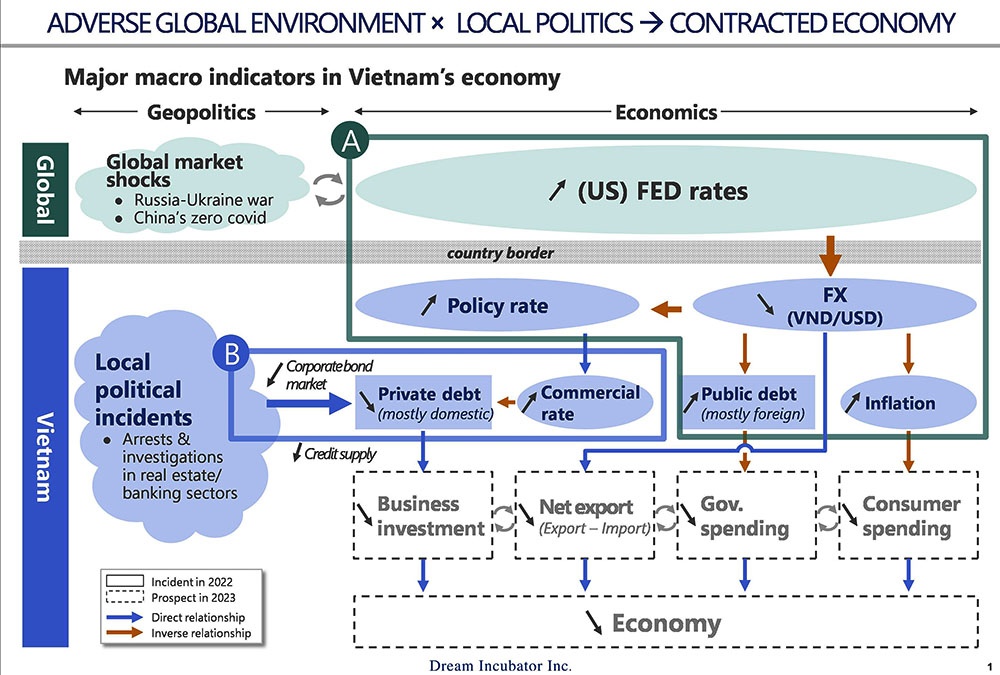

2022 was filled with geo-political turmoil which reversed the anticipated post-COVID recovery momentum across the globe. While an array of drastic measures have been taken by the Vietnamese government, the local economy is still predicted to suffer disturbances over the coming year, according to a report by Dream Incubator that was released this month.

In 2022, a series of major incidents took place both internationally and domestically, which in turn had a substantial impact on the Vietnamese economy. Specifically, at a global level, the Russian-Ukraine conflict broke out in early February. Soon after that, energy shortages and supply chain disruptions triggered soaring inflation in the US and other countries. The US government responded with a series of rate hikes, putting pressure on the monetary policies of countries around the world, including Vietnam.

Domestically, the above series of events put strong pressure on Vietnam to control exchange rates and inflation. At the same time, an array of arrests – mostly in the real estate sector – such as Van Thinh Phat and Tan Hoang Minh took an additional toll on the local economy. The negative impact was mostly manifested through fluctuations in interest rates and the government’s effort to revamp the local corporate bond market.

The local economy is likely to experience disturbances, not only in 2022 but also 2023. The outlook is grey across all core components of the local economy including business investments, imports and exports, and government and consumer spending.

Firstly, a series of Fed rate hikes in 2022 triggered central banks around the world, including Vietnam, to increase policy rates accordingly in order to keep inflation and exchange rates in check. Consequently, capital became more expensive and harder to access for local enterprises.

Secondly, in terms of trade, the steep appreciation of the USD against the VND inflated the cost of imported inputs from overseas, thus posing major challenges to local manufacturing firms and inflation control.

Thirdly, as the value of existing public foreign debt would surge as a result of exchange rate fluctuations, public spending was likely to be cut back.

Lastly, given the shrinking income and low confidence in the future of the economy, local consumers would have no other choice but to tighten their belts.

In light of the uncertainty, the government has taken drastic measures both in terms of monetary policy and regulatory adjustments to recover the local economy. Regarding monetary policy, the State Bank of Vietnam continuously adjusted upward policy rates in the latter half of 2022 to control inflation and exchange rate fluctuations. In December 2022, the local government raised the credit growth target by 1.5 to 2 per cent (equivalent to $10.4 billion in new money supply). This was applicable to all financial institutions, lifting the previous credit limit from 14 to 16 per cent. The purpose was to incentivise certain prioritised sectors including agriculture, exports, and real estate (particularly within the social housing segment).

The Vietnamese government also took a firm hand on the revamp of the local corporate bond market, which had been notoriously known for its lack of transparency and default risk. However, solely relying on monetary supply will not suffice. Many more actions are to be needed to allow better money absorption from the development to sales, thus allowing more liquidity and reinvestments in the new year.

Read the full report on the Review of Vietnam’s Economy 2022 here

Source: VIR

Related News

GOLDEN DEAL, KNOCK-DOWN OFFER

Are you ready for a fun-filled family vacation. Don't miss the super attractive Family Staycation package at Becamex Hotel. 2 days 1 night package with full amenities and free activities: Buffet breakfast, Swimming, tennis, bicycle, gym, sauna, cool ice cream, 300.000 VND service voucher and many other offers! Contact now for detailed advice.

"BEARY CHRISTMAS" CHARITY PROGRAM

As the Festive Season approaches, Caravelle Saigon, in collaboration with VinaCapital Foundation (VCF), is bringing a heartwarming charitable initiative to life — and we are delighted to invite all HKBAV members to take part in the very first “Beary Christmas” Charity Program. By adopting a Caravelle Bear for VND 299,000 nett, you will be directly supporting children battling cancer in Vietnam through VCF’s Can-Care/Can-Clover Program.

SOILBUILD INTERNATIONAL WINS “BEST INDUSTRIAL DEVELOPMENT” AWARD FOR SPECTRUM NGHE AN AT THE PROPERTYGURU VIETNAM PROPERTY AWARDS 2025

Soilbuild International is pleased to announce that its project, Spectrum Nghe An, has been awarded Best Industrial Development at the PropertyGuru Vietnam Property Awards 2025, held on 24th of October 2025, in Ho Chi Minh City. The PropertyGuru Vietnam Property Awards is part of the prestigious PropertyGuru Asia Property Awards series, the largest and most respected real estate awards programme in Asia.

WEBINAR: 2025 VIETNAM KEY TAX FINALISATION, UPDATES ON TAX CHANGES AND GLOBAL MINIMUM TAX

Dear Valued Client,We would like to invite you to our webinars on Friday, 12 December 2025, and Tuesday, 16 December 2025, to review and learn about key 2025 tax finalisation topics and stay ahead with the latest tax changes.

NEW ECONOMIC POLICIES EFFECTIVE THIS DECEMBER

Government Decree 304/2025, effective December 1, sets stricter conditions for seizing collateral, especially assets that are a borrower’s sole residence or essential work tools. In such cases, lenders must set aside a compensation amount equivalent to six to twelve months of minimum wage. The measure aims to improve transparency in bad debt handling and reduce credit risk in the banking system.

QUANG NINH TARGETS VND58 TRILLION IN TOURISM REVENUE

Quang Ninh Province is aiming to generate VND58 trillion in tourism revenue this year after surpassing its goal of 21 million visitors, driven by new tourism products, expanded nighttime activities, and large-scale events. As of mid-November 2025, Quang Ninh had welcomed 21.28 million visitors, up 12% year-on-year. Tourism revenue reached at least VND57 trillion, a 22.46% increase from the same period last year. With its visitor target achieved, the province is now pushing toward its revenue goal of VND58 trillion.