NEW INDUSTRIAL PARK IN HAIPHONG: A STRATEGIC HUB FOR ATTRACTING FDI INFLOWS

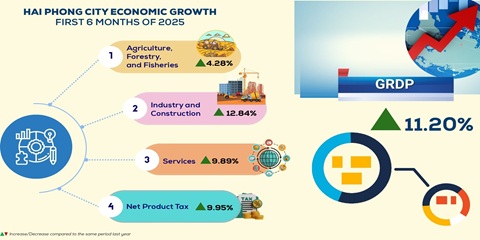

In the first six months of 2025, the region’s GDP saw a robust growth rate of 11.2 per cent, with the industrial sector surging over 12.8 per cent and services by 9.9 per cent. Cumulative FDI in post-merger Haiphong has now exceeded $50 billion, coming from 1,724 active projects, primarily in key sectors such as processing, manufacturing, and logistics.

REAL ESTATE M&A SURGE WITH DOMINATION OF FOREIGN GIANTS

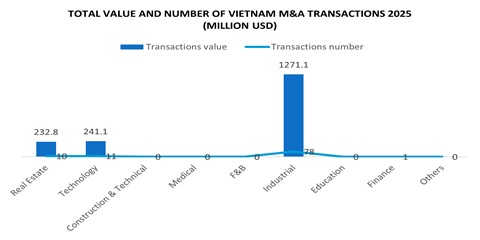

The Vietnamese real estate market is experiencing an unprecedented surge in mergers and acquisitions (M&A), with both domestic and foreign companies actively driving growth in this vibrant sector. According to a recent report by Grant Thornton Vietnam, the total value of M&A transactions in the country reached approximately US$4.8 billion in the first eight months of 2025, representing a 21 per cent increase from the same period last year.

HCM CITY ATTRACTS $4.4 BILLION INTO INDUSTRIAL PARKS IN NINE MONTHS

Total registered investment, including new and adjusted capital across the three areas of HCM City, Bình Dương and Bà Rịa – Vũng Tàu (former administrative units), reached US$4.4 billion. This represented 96.4 per cent of the same period last year and 117.96 per cent of the 2025 annual target. As many as 197.43 hectares of land and more than 63,000 square metres of factory space were leased.

EMERGING TRENDS IN VIETNAM’S REAL ESTATE MARKET 2025

Vietnam has set an ambitious GDP growth target of 8.3–8.5% for 2025, expected to drive strong momentum across the green economy, digital economy, and digital transformation, particularly in mergers and acquisitions (M&A). The “Emerging Real Estate Trends in Vietnam 2025” report, recently released by Indochina Strategic—the real estate advisory arm of Indochina Capital (ICC)—highlights 10 emerging trends shaping Vietnam’s real estate M&A market.

INDUSTRIAL PROPERTY MARKET DRAWS FRESH WAVE OF FOREIGN INVESTMENT

Việt Nam’s industrial property market is heating up as foreign investors pour billions of dollars into factories, warehouses and ready-built facilities, driven by accelerating supply chain shifts and a new surge of global capital. Foreign direct investment (FDI) into Việt Nam hit US$26.1 billion in the first eight months, up more than 27 per cent from a year earlier, according to the General Statistics Office.

VIỆT NAM SEES RISING FOREIGN INVESTMENTS DESPITE UNCERTAINTIES

Foreign investors continue to show strong interest in Việt Nam, with foreign investments in the first seven months up more than 27 per cent on-year despite geopolitical uncertainties and trade tensions. A recent highlight is ExxonMobil, the American oil and gas giant, conducting a site survey in the Nam Vân Phong area to explore investment opportunities.

MEGA-INDUSTRIAL HUBS TO POWER GROWTH LEAP

Mega industrial hubs are taking shape in Việt Nam following a historic administrative overhaul, at the heart of which are landmark mergers including Bắc Giang with Bắc Ninh in the north and Bình Dương and Bà Rịa – Vũng Tàu with HCM City in the south. Beyond its administrative significance, the merger creates a development space that is broader, more sustainable and more comprehensive, and forms cohesive industrial powerhouses which are expected to propel Việt Nam to sustained double-digit growth in the new era.

REAL ESTATE SECTOR SEES STRONG FOREIGN CAPITAL INFLOWS

The real estate market has heated up since early 2025, with major mergers and acquisitions (M&A) driven by investors from Japan, South Korea, and Singapore, alongside rising capital inflows from the U.S. and Europe. Specifically, CapitaLand spent US$553 million acquiring a project in the former province of Binh Duong (now HCMC) from Becamex IDC, according to the Vietnam News Agency.