Want to be in the loop?

subscribe to

our notification

Business News

BALANCING GROWTH IN IPS AMID SURGING FDI

As Vietnam continues its path toward integration and modernization, industrial parks (IPs) and economic zones (EZs) are playing a pivotal role in driving economic growth, attracting foreign direct investment (FDI), and generating large-scale employment.

Formed through a cooperation model between Vietnam and Singapore, VSIP now operates 20 IPs in Vietnam, covering more than 14,000 ha. It has attracted over 900 FDI projects from 30 countries and territories, generating around 300,000 jobs.

After over 30 years in Vietnam, Amata has established a strong reputation. With 3,000 ha of industrial, commercial, and service land, it has drawn over 220 multinational corporations with total investment exceeding US$6.7 billion, creating more than 60,000 jobs.

Competitive edge of Vietnam’s IPs

One of the most significant advantages propelling Vietnam’s IPs and EZs in the race to attract global investment is their strategic geographical location. Deep C sits adjacent to the Lach Huyen deep-water port and connects directly to the Hanoi–Hai Phong Expressway. VSIP projects in Binh Duong, now integrated into the administrative boundaries of Ho Chi Minh City, have become a key transit hub in the Southern supply chain. Meanwhile, Amata in Dong Nai enjoys seamless access to the Cai Mep–Thi Vai International Port, one of the region’s most critical export gateways.

In the North, Texhong Hai Ha leverages its proximity to the Mong Cai International Border Gate, while Nam Son – Hap Linh and Yen Phong benefit from their close distance to Noi Bai International Airport. Quang Yen EZ is strategically located along the Quang Ninh–Hai Phong–Hanoi economic corridor, and Van Don EZ stands out with a comprehensive infrastructure complex including an international airport and the Van Don–Mong Cai expressway, opening up multidimensional logistics connectivity.

Beyond location, Vietnam’s IPs and EZs are also advancing through increasingly modern and synchronized technical infrastructure. Deep C features a rare liquid cargo jetty in Northern Vietnam capable of handling 20,000 DWT vessels. VSIP incorporates an integrated model of industry, urban living, and services, creating a livable and efficient environment for professionals and high-skilled workers. Amata Dong Nai has invested in state-of-the-art wastewater treatment systems that meet stringent environmental standards.

Infrastructure aside, investment incentives and institutional reforms are key drivers enhancing the appeal of Vietnam’s IPs and EZs. Those located in key economic regions, such as Deep C and Van Don, offer corporate income tax exemptions for the first two years and a 50% reduction over the following four years. Notably, effective from January 15, 2025, the revised Law amending four major laws (Planning, Investment, PPP, and Bidding) introduces a "special investment mechanism" that can shorten procedures by up to 260 days, a major leap in improving the investment climate.

Another notable strength of Vietnam’s IPs and EZs is their capacity to foster diverse and self-sustaining industrial ecosystems. VSIP Trang Due has attracted over 50 supporting firms for LG, while Yen Phong has become a leading electronics manufacturing hub anchored by Samsung. Amata and Texhong Hai Ha are positioning themselves as high-tech centers, catering to streamlined, high-standard production needs.

Strategic shift needed to sustain momentum

One of the most pressing bottlenecks lies in the quality of human resources. FDI enterprises, especially in high-tech sectors such as semiconductors and artificial intelligence, frequently report a mismatch between recruitment needs and the training quality provided by educational institutions. The connection between academia and industry remains weak, resulting in an oversupply of low-skilled labor and a shortage of technically trained workers.

Rapid expansion has placed significant strain on infrastructure in many IPs, particularly in the Mekong Delta and North Central regions. Frequent power shortages, traffic congestion on key transport routes, and delays in planning approvals have all impacted project timelines and investor confidence.

Environmental infrastructure remains another critical shortfall. Statistics indicate that approximately 15% of IPs in Vietnam still lack centralized wastewater treatment systems, a concerning figure given the global shift toward sustainable development standards.

In the increasingly competitive race for global investment, Vietnam is under mounting pressure from countries like Indonesia and India, both of which are rapidly improving their incentive policies and ramping up infrastructure and workforce investments in high-tech sectors. Meanwhile, domestic linkages between Vietnamese firms and FDI enterprises remain weak.

To maintain investor appeal and elevate the stature of its IPs and EZs, Vietnam must implement a broad array of strategic solutions. First and foremost, a new model of collaboration should be built among IPs, businesses, and educational institutions to align training with market demands, especially in digital and core technology fields. Infrastructure investment must be holistic, encompassing power supply, transportation, and waste treatment, while also prioritizing renewable energy and circular economy practices.

Source: VCCI

Related News

PRACTICAL CONSTRUCTION WORK

At Phuc Vuong, we do not focus on talking about our capabilities. Instead, every project currently under construction serves as the clearest and most direct proof. From site preparation, piling works, and foundation construction to structural works and major items, our technical team remains closely involved on site, monitoring every detail.

INTERNATIONAL ARRIVALS TO PHU QUOC AT RECORD HIGH

On January 17, Phu Quoc International Airport handled 47 international flights in a single day, the highest level since the airport began operations. Earlier, on January 3, the airport had already set a new record with 46 international flights in one day. Notably, the surge was not confined to a few peak days. International arrivals were maintained at a high level throughout January, pointing to a more sustained and stable expansion of the international travel market to the island.

VIETNAM PUTS SCIENCE, TECHNOLOGY AT CENTER OF 2026 GROWTH STRATEGY

Vietnam will make science and technology, innovation and digital transformation the core drivers of economic growth in 2026, under a Government resolution guiding this year’s socio-economic development and budget implementation. The direction is set out in Resolution No. 01 on key tasks and solutions for 2026, reported the Government news website (baochinhphu.vn).

VIETNAM ECONOMIC NEWS INSIGHT & RECAP - DECEMBER 2025

Vietnam closed 2025 with an impressive economic performance, exceeding initial targets and demonstrating the resilience of its growth model. Full-year GDP expanded by 8.02% supported by a combination of government-led stimulus, stable domestic production and consumption, and continued strength in key export sectors amid ongoing external uncertainties.

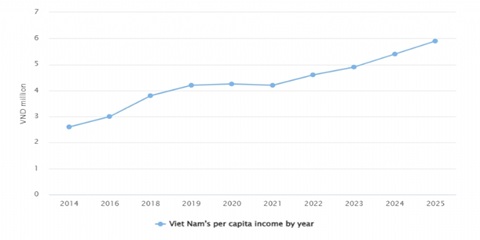

PER CAPITA INCOME CLIMBS 9.3% IN 2025

Average per capita income in 2025 was estimated at VND5.9 million (approximately US$225) per month, marking a 9.3 percent increase from 2024, according to preliminary findings of the Household Living Standards Survey 2025 conducted by the National Statistics Office (NSO). Part of the income growth stemmed from State payments to public officials and employees who retired or resigned under the restructuring of the political system's organizational apparatus.

INDUSTRY AND TRADE SECTOR MAINTAINING GROWTH MOMENTUM, FORGING SUSTAINABLE DEVELOPMENT

In 2025, Hai Phong City benefited from significant opportunities created by an expanded development space following administrative consolidation, while also facing challenges in maintaining stable and efficient administrative operations and sustaining strong economic growth amid ongoing global volatility. Within this context, the industry and trade sector continued to serve as an important driving force for the city’s overall economic growth.