Want to be in the loop?

subscribe to

our notification

Business News

RESORT REAL ESTATE MARKET SHOWS POSITIVE SIGNS

The resort real estate market is recording positive signs as demand, in both domestic and international tourist markets, is gradually recovering at a stable pace, thereby helping strengthen trust in the industry, according to Mauro Gasparotti, Director of Savills Hotels.

Hanoi The resort real estate market is recording positive signs as demand, in both domestic and international tourist markets, is gradually recovering at a stable pace, thereby helping strengthen trust in the industry, according to Mauro Gasparotti, Director of Savills Hotels.

According to a survey by Savills Vietnam, there are currently many projects in the process of restarting. In the past few months, feasibility study consulting or hotel operator selection services have received many search requests. Among them, Da Nang stands out with the advantage of connectivity infrastructure and diversity of tourism products and accommodations, and is expected to continue to lead the recovery process.

Destinations that are familiar to domestic tourists such as Quy Nhon or Phu Yen also have more and more projects being planned. These localities are also focusing on developing transportation infrastructure and high-end accommodation products to attract more foreign visitors.

The trend of wellness resorts integrated with models such as onsen (hot springs and the bathing facilities and traditional inns around them) or medical tourism is increasingly being developed by investors.

In addition, the luxury segment continues to receive huge attention from investors. The luxury – high-end hotel market in Ho Chi Minh City is expected to maintain a competitive advantage in the next few years because new supply is still limited. However, according to experts, the city still needs to diversify the types of accommodation products to meet the needs.

As for hotels and service apartments, the Hanoi market has also recorded an increase in the number of projects in the planning process. In addition, the middle- and high-end hotel segments have also reported good growth rates in locations adjacent to industrial parks.

Currently, with positive signs from the market, merger and acquisition (M&A) activities are increasing as well. In addition to operating projects with stable cash flows, a number of previously delayed or unfinished projects are also in the process of being transferred to new investors.

Source: VIR

Related News

PRACTICAL CONSTRUCTION WORK

At Phuc Vuong, we do not focus on talking about our capabilities. Instead, every project currently under construction serves as the clearest and most direct proof. From site preparation, piling works, and foundation construction to structural works and major items, our technical team remains closely involved on site, monitoring every detail.

INTERNATIONAL ARRIVALS TO PHU QUOC AT RECORD HIGH

On January 17, Phu Quoc International Airport handled 47 international flights in a single day, the highest level since the airport began operations. Earlier, on January 3, the airport had already set a new record with 46 international flights in one day. Notably, the surge was not confined to a few peak days. International arrivals were maintained at a high level throughout January, pointing to a more sustained and stable expansion of the international travel market to the island.

VIETNAM PUTS SCIENCE, TECHNOLOGY AT CENTER OF 2026 GROWTH STRATEGY

Vietnam will make science and technology, innovation and digital transformation the core drivers of economic growth in 2026, under a Government resolution guiding this year’s socio-economic development and budget implementation. The direction is set out in Resolution No. 01 on key tasks and solutions for 2026, reported the Government news website (baochinhphu.vn).

VIETNAM ECONOMIC NEWS INSIGHT & RECAP - DECEMBER 2025

Vietnam closed 2025 with an impressive economic performance, exceeding initial targets and demonstrating the resilience of its growth model. Full-year GDP expanded by 8.02% supported by a combination of government-led stimulus, stable domestic production and consumption, and continued strength in key export sectors amid ongoing external uncertainties.

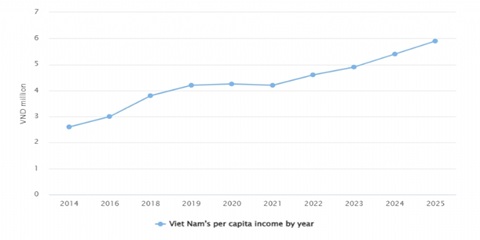

PER CAPITA INCOME CLIMBS 9.3% IN 2025

Average per capita income in 2025 was estimated at VND5.9 million (approximately US$225) per month, marking a 9.3 percent increase from 2024, according to preliminary findings of the Household Living Standards Survey 2025 conducted by the National Statistics Office (NSO). Part of the income growth stemmed from State payments to public officials and employees who retired or resigned under the restructuring of the political system's organizational apparatus.

INDUSTRY AND TRADE SECTOR MAINTAINING GROWTH MOMENTUM, FORGING SUSTAINABLE DEVELOPMENT

In 2025, Hai Phong City benefited from significant opportunities created by an expanded development space following administrative consolidation, while also facing challenges in maintaining stable and efficient administrative operations and sustaining strong economic growth amid ongoing global volatility. Within this context, the industry and trade sector continued to serve as an important driving force for the city’s overall economic growth.