Want to be in the loop?

subscribe to

our notification

Business News

MANUFACTURING SECTOR STARTS 2026 ON SOLID FOOTING

Workers process wood at a facility in Vietnam - PHOTO: DAT THANH

HCMC – The manufacturing sector continued to expand in January, supported by faster growth in output, new orders and employment, according to S&P Global.

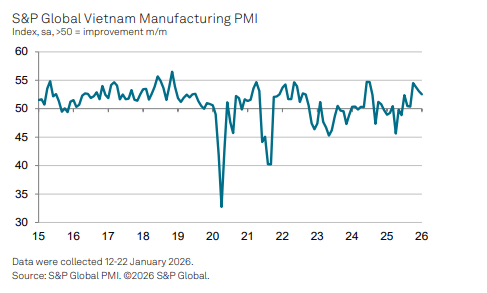

The Vietnam Manufacturing Purchasing Managers’ Index (PMI) slipped slightly to 52.5 in January from 53.0 in December 2025. The reading remained well above the 50 mark that separates expansion from contraction, signaling a seventh consecutive month of improving business conditions.

Production growth accelerated at the start of the year as manufacturers responded to stronger demand. Survey respondents attributed higher output mainly to an increase in new orders, which rose at a faster pace than in December amid better customer demand.

Export orders returned to growth, marking the third increase in the past four months. Although the expansion was modest, firms reported receiving new business from several Asian markets, including India.

A line chart shows the S&P Global Vietnam Manufacturing Purchasing Managers’ Index from 2015 to January 2026, with the index remaining above the 50-point expansion threshold in January at 52.5, indicating continued improvement in manufacturing conditions – PHOTO: S&P Global

Employment rose for a fourth straight month, with the pace of job creation reaching its fastest level since June 2024. Some companies noted that part of the hiring was temporary, reflecting short-term production needs.

Purchasing activity also increased, extending a seven-month growth streak, as firms bought more inputs to support higher output. However, inventories of raw materials declined for the first time since September as stocks were used to meet production requirements. Finished goods inventories also fell, with companies reporting quicker shipment of products to customers.

Supply constraints continued to affect the sector. Suppliers’ delivery times lengthened again, though at the slowest pace in eight months. Firms cited strong demand for inputs and material shortages as the main causes.

Cost pressures remained elevated. Input prices rose sharply in January, only slightly below December’s three-and-a-half-year high. Manufacturers passed these costs on to customers, pushing selling prices up at the fastest rate since April 2022.

Despite inflation concerns, business confidence improved. Optimism about output over the next 12 months climbed for the fourth consecutive month to its highest level since March 2024. About 55% of surveyed firms expect production to increase over the coming year, driven by expectations of sustained order growth and improving market conditions.

Andrew Harker, economics director at S&P Global Market Intelligence, said the sector carried positive momentum into 2026 as firms expanded output to meet demand. He noted that inflationary pressures remain a potential risk, although demand has so far shown resilience.

Data for the survey were collected between January 12 and 22 from around 400 manufacturers across Vietnam.

Source: The Saigon Times

Related News

INFOGRAPHIC SOCIAL-ECONOMIC PERFORMANCE IN FEBRUARY OF 2026

The monthly statistical data presents current economic and social statistics on a variety of subjects illustrating crucial economic trends and developments, including production of agriculture, forestry and fishery, business registration situation, investment, government revenues and expenditures, trade, prices, transport and tourism and so on.

A NEW CHAPTER BEGINS: PHUC VUONG IS READY TO PARTNER FOR 2026 PROJECTS

As the Lunar New Year holiday concludes, it is time to turn aspirations into reality. Embracing the vibrant energy of the new year, Phuc Vuong is officially open and ready to undertake new construction projects for 2026. In the world of construction, we understand that a blueprint is more than just concrete and steel—it represents the vision and dedication of the investor.

MANUFACTURING SECTOR HITS FOUR-MONTH HIGH ON STRONGER DEMAND

Vietnam’s manufacturing sector expanded at a faster pace in February, with the Purchasing Managers’ Index (PMI) rising to 54.3 from 52.5 in January, marking the strongest improvement in four months, according to S&P Global. The reading remained well above the 50-point threshold that separates expansion from contraction. It also extended the sector’s current growth streak to eight consecutive months, reflecting improving business conditions.

DURIAN EXPORTS PROJECTED TO HIT US$1 BILLION IN Q1

Vietnam can gain US$1 billion in revenue from durian products exports within the first quarter of this year, provided that customs clearance at northern border gates remains favorable. This optimistic outlook was given by the Agency of Foreign Trade under the Ministry of Industry and Trade following a good start to the year, with January figures reaching over US$117 million, up by a staggering 275% year-on-year.

HCMC LOOKS TO LURE US$11 BILLION IN FDI FOR 2026

To reach the milestone – a significant jump from US$8.37 billion in 2025 – the city is adopting a selective high-quality approach. Priority is given to high-tech and digital transformation with semiconductor, AI, and data centers; logistics and finance with the Vietnam International Financial Center in HCMC and the Cai Mep Ha Free Trade Zone and smart infrastructure with transitioning existing industrial parks into eco-smart models.

TRADE DEFICIT WIDENS IN EARLY FEBRUARY AS IMPORTS SURGE

Vietnam posted a trade deficit of about US$948 million in the first half of February 2026, as imports rose faster than exports, according to preliminary data from the Department of Vietnam Customs. Total trade between February 1 and 15 reached US$41.67 billion. Exports stood at US$20.36 billion, while imports totaled US$21.31 billion.